| Home | Quotes | Biographies | Free Essays and Articles | Discussion Forum |

The Recession of 2008 and 2009, and how to get out of it

- Beginning in the first quarter of 2008, the United States, the strongest nation economically, descended into a recession.

- The objective is to get the United States out of the recession slump and into long-term economic growth.

- A $700 billion bailout plan was approved by congress, however signs of improvement in the economy are lacking. In fact, the week after the bailout bill was passed, the Dow Jones fell 800 points. 1

- The alternatives are for more Keynesian spending, or a more fiscally conservative approach by letting the recession take a full swing by passing legislation preventing subprime mortgages.

- The criterion to determine the best alternative include the minimization of unemployment, minimize the people’s suffering, and long term economic growth.

- A model would require analysis of economic indicators in response to government measures such as spending as well as loans in the form of bailouts.

- Massive government spending may help in the short-term, however it is only a temporary reprieve from the recession. Passing legislation against the very actions that caused the recession would solve the problem in the long-term, but make matters worse in the short-term.

- The best alternative is for the government to employ a hands off laissez-faire policy and let the economy self-correct itself.

- The results cannot be audited yet, because my recommendations go largely unheeded.

References:

1. http://articles.latimes.com/2008/oct/07/business/fi-markets7

- Recognize the problem:

The economic crisis that started in early 2008 stems from many factors. The main factor at play is interest rate and its effect on the ease of obtaining credit in relation to mortgages. Since so much capital and investment was tied up in these mortgages, the decline in home prices began to have a snowball effect. With unemployment up, stock price indices down, and consumer confidence decreasing, the economic crisis begs for a solution. The US government has attempted several actions to cure the recession, however none has truly been successful. In light of these circumstances, the problem becomes how best get the United States economy out of recessionary tendencies, and back into long term growth.

- Define the goal or objective:

In response to the stated problem, the objective is two-fold: First, to get the economy on the path to recovery by way of affecting leading economic indicators. Second, any action taken now in the short term must also prevent future crises from arising for the same reasons as the current one.

- Assemble relevant data:

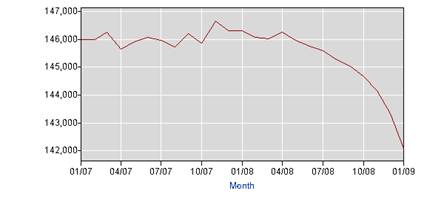

According to the Bureau of labor statistics 1, the employment level has been consistently on the decline since April 2008. From the figure shown below, the number employed has gone from 146,257,000 in April 2008 to 142,099,000 at the end of January 2009. This is a drop in more than 4 million.

Particularly bad is the shape of the curve, which shows that the rate of unemployment is increasing.

The US government has come out with several programs to combat the economic crisis, including a $700 billion bailout plan was approved by congress, however signs of improvement in the economy are lacking. In fact, the week after the bailout bill was passed, the Dow Jones fell 800 points. 2

Gross Domestic Product (GDP) is also a leading indicator of economic growth, and it fell 3.8 percent annually in last quarter of 2008. 3 The reason is mostly due to the low consumer confidence levels which adversely affect consumer spending, which in turn makes up the bulk of GDP. The US senate will vote on an upcoming $780 billion stimulus package next week which may have the same outcomes as the bailout package. 4 For the time being, Wall Street is responding well to the stimulus plan as the DJIA went up 2.7% on Friday February 7th 2009. 5

Another leading indicator of economic growth is the Consumer Confidence Index (CCI). In January of 2009, it reached an all time low of 37.7. 6

References:

1. http://www.bls.gov/data/

2. http://articles.latimes.com/2008/oct/07/business/fi-markets7

3. http://www.bloomberg.com/apps/news?pid=newsarchive&sid=ajyQfLEU77e4#

4. http://www.bloomberg.com/apps/news?pid=20601087&sid=a6aaWZ8ab8yU

5. http://finance.google.com/finance?q=.dji

6. http://www.conference-board.org/economics/ConsumerConfidence.cfm

- Identify feasible alternatives:

One feasible alternative is monetary policy enacted by the Federal Reserve. The Federal Reserve can alter interest rates and the amount of money in circulation by using three methods. The first is the reserve requirement. Money is created whenever banks give loans, and the reserve requirement directly influences just how much money banks can create. This in turn affects the economy because it relates to how much money will be exchanging hands.1 For this alternative, the Federal Reserve would lower the reserve requirement so banks could make more loans per given amount of assets. Another monetary policy alternative is adjusting the discount rate. This is the rate which the Fed charges banks for short term loans.2 This alternative would entail decreasing the discount rate such that credit will be easier to obtain. The last alternative relates to open market operations, where the Federal Reserve buys and sells securities. By doing so, the Fed can affect the ease of obtaining credit. This alternative is very important because open market operations are the principle monetary policy tool.3 In this case, the Fed would buy securities from banks, which would in turn lend a portion of the money obtained from the Federal Reserve.

Another alternative is fiscal policy, which can come in several varieties. First, fiscal policy can be enacted in the form of a stimulus plan. Since the Obama administration is already taking this approach, this alternative essentially means continuing with the stimulus, and if the economy gets worse, enacting another stimulus plan. Second, the Federal government can bail out select companies. This approach can either provide some sort of a loan, or nationalize a company. Again, this policy is currently being pursued; first by former president Bush, and now by Obama. So far the bailouts have consisted of Bear Stearns, Fannie Mae, Freddie Mac, GM, AIG, Chrysler, and Bank of America. The alternative becomes tricky in deciding which companies to bailout, if any. William Isaac, the former chairman of the FDIC asks “are you going to do General Motors and Ford, and, if you do those, are going to go on and do retailers? […] Where does it stop? That is a very difficult decision we are going to face as a country”.4 Besides bailout, the stimulus can involve helping homeowners who have defaulted on their mortgages. Recently, the Federal government “doubled the size of its commitment to Fannie Mae and Freddie Mac, increasing the guarantee against losses on their mortgage investments to $400 billion”.5

Third, another fiscal policy alternative is to decrease taxes. In this case, the Federal government will provide further tax rebates as under the Bush Administration, or decrease taxes for individuals. This alternative also involves decreasing business taxes in an effort to employ supply-side economics.

Fourth, the Federal government can enact new legislature that will prevent exploitation of the factors that caused the current recession. This plan is really forward looking but not good in the short term. Basically this alternative entails new laws that make it harder for citizens to obtain mortgages with little money down.

The last alternative is the do-nothing approach, where both fiscal and monetary policies are neglected in favor of letting the economy naturally correct itself. This approach embodies the ideas of Milton Friedman, who “argued that government should simply manage the supply of money — to keep it growing with the economy — then step aside and let the market do its magic”.6

- Select Criterion to determine the best alternative:

The criteria used to determine the best alternative include cost, time to execute, time to have an effect, and type of effect, whether long term or short term.

Cost is an important element because it involves how much money will have to be spent over a certain number of years. Payment for an alternative may not require a full upfront sum, but rather continuous or incremental payments.

Time to execute is relevant because it determines just how long a certain alternative will take to fully be executes. The longer this time takes, the longer the recession persists in the short-term.

Time to have an effect is an important criterion because it relates to how much suffering the people must endure before the recession ends, and the economy is back on the path to recovery.

Type of effect is last, but the single most important element in determining the best alternative. While the short term alternatives may fix the economy in the short run, the economy may resort back to contraction in later years. Thus, a subset of long-term criterion will be to ensure that the factors that led to the recession are halted.

One criterion that has been left out is human suffering because of the recession. The reason is that it is implicitly assumed in each individual alternative. In other words, each alternative attempts to minimize long term suffering.

- Construct a model:

One essential element in the economic model proposed here is Gross Domestic Product. Since recession is defined by two consecutive quarters of GDP loss, each alternative must be evaluated in terms of its effect on GDP. GDP is influenced by Consumption, Investment, Government Spending, and Net Exports. Thus, GDP can change if one of its elements increases or decreases. If the Federal Reserve lowers the reserve requirement or ratio, banks will give out more loans. This in turn increases the amount of money in circulation because more goods are being purchased. In this fashion, consumption and investment will increase, and consequently boost GDP. By decreasing the discount rate, or buying securities, the Federal Reserve can likewise indirectly increase GDP. The Federal government can also increase GDP through the aforementioned alternatives; namely through the fiscal means of spending money. By creating a stimulus plan, or bailing out a company, the Government spending component of GDP increases. This is the back-bone of Keynesian economic theory. Next, by taxing individuals less, the Federal government collects less money to spend, but also puts more money in consumer’s pockets, which boosts consumer spending and consequently GDP. Decreasing business taxes has a similar effect. New legislature that makes buying homes more difficult will reduce GDP in the short-term, however will prevent future recessions by preventing rampant speculation. The do nothing approach will allow GDP to take its course downwards in the short-term, however this approach relies upon the idea that these easy to obtain mortgages will be more difficult to obtain in the future, as companies learn from their mistakes. It is interesting to note that the do-nothing approach and the legislation approach end up at the same result, although the legislation approach is safer because it makes clear the causes of the current recession.

The Consumer Price Index (CPI) is another important element in the economic model. Any Federal Reserve action that attempts to boost GDP will inherently cause inflation to increase. Government spending has a less pronounced effect because it can only influence CPI indirectly by infusing more money into the economy.

Consumer Confidence Index (CCI) is also relevant for the economic model. It is difficult to accurately determine the effect of either fiscal or monetary policy on the CCI, however, situations will be examined on a case by case basis. By giving bailout money to Fannie Mae and Freddie Mac, the Federal government is sending investors and consumers the message that debt and mortgage-backed securities are infallible because they are by the U.S. Government. 5

Unemployment levels are also an important economic indicator which will be included in the model. The Federal Reserve alternatives can indirectly influence unemployment by allowing inflation to become too high. The fiscal measures can reduce unemployment through a stimulus plan or bailout of a large American company. One of the purported goals of the stimulus plan is to create new jobs. A bailout plan will keep workers of the bailed-out company employed rather than allowing the company to go bankrupt and laying off its employees. If the do-nothing alternative is chosen, unemployment would rise in the short-term, but eventually reach a critical point when growth starts to kick in. In this sense, unemployment can be seen as a lagging economic indicator.

References:

- Obringer, Ann, “How the Fed Works.” HowStuffWorks “How the Fed Works”. <http://money.howstuffworks.com/fed8.htm >.

- Obringer, Ann, “How the Fed Works.” HowStuffWorks “How the Fed Works”. <http://money.howstuffworks.com/fed9.htm >.

- Federal Reserve, “Open Market Operations.” FRB: Monetary Policy, Open Market Operations <http://www.federalreserve.gov/fomc/fundsrate.htm>.

- Torres, Craig. “Revised AIG Terms Begin Treasury Transfusions to 'Zombie' Firms.” Bloomberg 11 Nov. 2008.

- Appelbaum, Binyamin. “Government Doubles Available Aid to Fannie and Freddie.” Washington Post 18 Feb. 2009.

- Goodman, Peter, “A Fresh Look at the Apostle of Free Markets.” New York Times 13 Apr. 2008.

- Predict the outcomes for each alternative:

- Choose the best alternative:

- Audit the results:

The monetary policy alternative includes either lowering the reserve rate, lowering the discount rate, or engaging in open market operations. Since all of these Federal Reserve actions serve the same purpose, namely to increase the amount of money in the economy, the predicted changes will also be the same. The monetary cost associated with any Federal Reserve action can be neglected. By lowering the reserve requirement, the Federal Reserve will allow banks to increase their liabilities while decreasing the assets. This in effect allows banks to give more loans for the same amount of savings, and results in an infusion of money in the economy. Based on the model, this also results in an increase in GDP since more investment and consumer spending is taking place. While the increase in GDP is a benefit, any Federal Reserve action runs the risk of creating high inflation. The Federal Reserve “actively tries to maintain a specific rate of inflation, which is usually 2-3%”. 1 With a higher rate of inflation, the purchasing power of the dollar decreases, meaning less goods and services can be bought for the same amount of money in the future. In addition to the consumer price index increasing, higher inflation also leads to a higher unemployment rate. With a higher unemployment rate, consumer confidence would fall, but not as much as it would increase because of the availability of money.

By lowering the discount rate, the Federal Reserve would allow banks to make more loans because the interest rate is lower. More loans translates to more money being infused in the economy. Thus this option essentially leads to the same outcomes as the lowering of the reserve rate option. Unfortunately, the discount rate option must be predicted in light of current circumstances. The current Federal Discount rate is set at .5 % 2. This is almost zero, and there is practically no room for lowering the current discount rate.

The last Federal Reserve action outcome to be considered is the most important – open market operations. By buying and selling securities, the Federal Reserve affects the ease of obtaining credit for banks, and in turn consumers. By buying securities from banks, the asset side of the bank’s asset chart increases, meaning the banks can now loan out more money in keeping with the reserve ratio. Again this action indirectly creates more money in the economy, and will boost GDP while resonating with the possibility of creating high inflation and unemployment. Banks will be primarily affected by this change, but consumers will be next in line as they have an easier time of obtaining loans from banks. The time rate of any Federal Reserve action is almost immediate. It may take several months for the changes to propagate to consumers, which will then propagate throughout the entire economy as money exchanges hands. Those who will be least affected by any Federal Reserve measure are those who save money in the banks. While interest rates would decrease, and make these savers less money, interest rates are already so low that any decrease will pale in comparison to the effects a money injection will create in the economy. Also, businesses that rely on easy credit, such as the car industry, will see large benefits to any Federal Reserve action. Additionally, the housing market would rebound because of easier to obtain mortgages. Of course, this alternative has the implicit assumption that legislation would be passed making mortgages harder to obtain for those lacking the means of paying them back. Thus the prediction in relation to the housing market for any Federal Reserve alternative is for a normal rate of mortgage allowance, which will be significantly less than the artificial rate of mortgages given in the years preceding the current economic crisis.

In relation to a fiscal policy involving a stimulus plan, the outcomes tend to less short-term, and more long-term oriented. The Congressional Budget Office argues that “President Obama's economic recovery package will actually hurt the economy more in the long run than if he were to do nothing”3. The same office does suggest that “CBO said there is no crowding out in the short term, so the plan would succeed in boosting growth in 2009 and 2010”3. The time frame of a stimulus plan is thus set at between now and a few years. The immediate effects include more money pumped into the economy, less unemployment, and a general strengthening of the economy through government spending. Based on Keynesian multipliers, this alternative is likely to increase GDP in the short term, but create problems in the future when the stimulus money must be repaid, either through increased taxes or less government spending. The cost of the stimulus plan can vary, with the most recent stimulus plan running upwards of $838 billion, as the most recent stimulus plan.4 Of course, if this stimulus plan fails, then the next one would probably have to be even larger. The stimulus may have an added benefit of increasing consumer confidence in the short term, however there is also the flip-side that consumers see the stimulus as a sign that the economy is in dire straits. The most affected in the short term by the stimulus plan would be the unemployed, as they would now have work. These same people might not have work after the stimulus period is over, because it only allocates money for several years. In order to prevent this, a new stimulus plan would have to be erected, and a cycle of boom and bust would be created. The most affected would be the middle and upper classes, who would be forced to pay the increased taxes that will fund of the stimulus plan. The least affected people would be those who already have employment.

Another fiscal policy option is for bailing out or nationalizing companies as they fail. This approach is the most socialist as it leads to larger government share in failing companies. The effect of bailouts on consumer confidence does not bode well for the economy, as angst builds up why certain companies are receiving bailouts when others are simply allowed to fail. Moreover, the bailout money has to come from somewhere, and taxpayers are not happy to see their hard earned money go towards worthless companies. Whenever bailouts start happening the government places itself on a slippery slope. If more and more companies fail, the government has no choice but to keep bailing out more and more companies until it owns every industry and business in the country. Of course this is a doomsday scenario, however it must not be overlooked in the long-term. The time frame for bailouts is remarkably uncertain, as there is no real indication when the government would relinquish its control of a bailed-out company. This time frame could range from 5 years to 30 years to 100 years. Moreover, if the recession persists, and the bailed-out company continues bleeding money, future taxpayers money is put in jeopardy. By January of 2009, the government provided $250 billion to banks in exchange for preferred stock, but “a recent review by The Associated Press found that after receiving billions in aid from U.S. taxpayers, the nation's largest banks can't say exactly how they're spending the money. Some wouldn't even talk about it”5. For this reason it is especially hard to predict the outcomes of the bailouts, however it is fairly certain that most of the bailed-out companies would have failed or gone to bankruptcy if not for the bailout. In the short-term, the effects would ripple out to other industries, however in the long-term, this is for the best. Companies that fail do so for many reasons, the least of which being lack of competiveness (as in General Motors case). If the bailout case were applied in a time of economic growth, it would seem ludicrous and extremely corrupt. In this fashion, it is no surprise that “Banks, automakers and other companies that have received U.S. bailout money spent $114 million on lobbying and campaign contributions last year”6. Thus, the outcome of more bailouts would be increased corruption and ties between government and private industry.

So far, nearly “350 companies have gotten payouts under the government's $700 billion bailout program”6. If the recession persists or accelerates, this $700 billion would also increase to never before seen amounts, until the United States government itself would need to be bailed out. The most affected by the outcome of bailouts would be the companies who are bailed out. In particular, the executives and top management would see immediate benefits, such as large bonuses and pay increases. We have already seen this, in the case of Merrill Lynch & Co., a company that was suffering from incredible loses before being purchased by Bank of America, a banking company that received a bailout! The only fact harder to believe is that “Merrill paid out billions of dollars in bonuses, even though it wound up posting a fourth-quarter net loss of $15.84 billion. For all of 2008, the 10 highest-paid Merrill executives got a total of $209 million, and 11 were paid more than $10 million each”7. The most affected also include taxpayers, or the middle and upper classes, as they are mostly responsible for the bulk of taxes. These people will be adversely affected because their money is helping fund companies that have worthless common stock. GDP would increase as the investment would increase because bailed-out companies have more money to spend (although it would not increase if all the money is put in executives’ pockets). GDP would also increase on the consumption side, because banks would have more money to lend. The least affected include consumers, who see no benefit whatsoever in the bailing out of failed companies.

The next outcome to be predicted is that of decreasing taxes. The immediate effects are an increased level consumer spending and investment (important components of GDP, since consumer spending accounts for more than 2/3 of GDP). If taxes go down for businesses, the balance sheets would begin to show positive profits, and consumer confidence would be restored in Wall Street. The time frame would take about a year because income taxes are filed once a year for most tax-payers. In addition to GDP increasing, less taxes translates to increased consumer confidence as consumers now have more money in their pockets. As consumers spend more money, the economy recovers and unemployment decreases as businesses hire more workers to increase supply in response to increased demand. The Consumer Price Index would most likely increase, but not reach high inflation levels. This alternative has a negative cost to taxpayers but a high cost to government which is currently already pursuing high levels of spending through bailouts and stimulus. A negative cost is of course a benefit to all taxpayers. Those that pay more taxes, however, would see a higher level of tax decrease, unless of course the tax reduction would be from the bottom up.

The last alternative’s outcome to be evaluated is that resulting from the do-nothing approach. In the short-term, the economy would proceed on its downward course, however it would naturally correct itself in the long-term. The cost of this approach is non-existent, but the short-term effects may be catastrophic. Large banks may fail left and right, bringing ruin to many other industries. FDIC would be forced to pay insurance to the bank’s creditors, which might spell ruin for the Federal Government. In respect to the model, the GDP would decrease in the short-term, probably for up to 3-5 years, but then it would grow in the long-term. Banks and the auto industries would be the most affected by the outcome in the short-term, however this would have a large chain reaction affecting all other industries. There would also be a large rise in unemployment in the short-term, as well as decreased consumer confidence. While the long-term outcomes are fairly certain and positive, the short-term implications may be catastrophic.

In evaluating each alternative, it was implicit that new legislation would have to be passed preventing the causes of the current economic crisis – that loans only be given to those that have the means of paying them back. By putting a damper on unwise speculation, future economic problems will be disallowed by fixing the root of the current problem.

The best alternative was thus shown to be the decreasing of taxes for individual taxpayers and for businesses. The cost to consumers was negative, meaning it was actually a benefit. The only cost is to the government, which would be forced to have a decreased budget. The timeframe was almost immediate because it would affect income taxes, which would be filed in a year or less. For these reasons this alternative had the best cost to benefit ratio and the shortest time to be implemented. Furthermore, it was best for the long-term as it means less government power in the future, resulting in more freedom and less socialism. Lastly, as previously mentioned, this alternative assumes that legislation will be passed to address the issue of bad loans.

1. The desired result of the bailout is to get banks lending money again, which would have the effect of revitalizing the economy. The bank bailout will affect the economy through several means. First, because banks have increased assets, the liabilities can increase in keeping with the required reserve ratio. In this manner, more loans will be given, and consumer confidence would slowly be restored. Current progress at attaining the desired result is rather limited for several reasons. As previously mentioned, companies that have been bailed out spent $114 million on lobbying. In particular, “Bank of America, together with the Merrill Lynch investment bank it acquired, spent $14.5 million on lobbying and contributions. The bank has received $45 billion under the government's $700 billion financial rescue fund”6. It makes absolutely no sense for Bank of America to buy Merrill Lynch after receiving bailout money. The lack of transparency in bailout money is also a major problem. The Federal Reserve refuses to give out the details of “the names of the borrowers and the loans, alleging that it would cast “a stigma” on recipients of more than $1.9 trillion of emergency credit from U.S. taxpayers and the assets the central bank is accepting as collateral”8. An action such as this only furthers the public’s view of the bailouts as corrupt and ineffective. Since taxpayer money is being used to fund failing companies, executive pay must be decreased and limited. Steps were taken in this direction in the most recent stimulus bill, which “contains a provision that limits bonus payments to no more than one-third of annual total compensation at banks and other companies that have taken federal bailout money”9. If a second bailout were to be passed (it probably will soon), it would have to be completely transparent.

2. The bank bailout plan does not resemble my recommended plan at all. As shown in part 7 and 8, the bank bailouts are largely ineffective and seemingly corrupt. The key difference in the bailout plan and my recommendation lies mostly in politics. My plan attempts to attenuate the future power of the Federal Government, while the bailout plan asserts the full power Federal Government for years to come.

3. The best way that the bank bailout could be better audited is to increase the transparency in all bailout dealings. Since the government is essentially using taxpayer money, all information relating to the beneficiaries of bailout funds must be fully made public. Moreover, the amounts of money given to banks must also be made public, such that corruption can be diminished.

My alternative could be audited by examining several years of past and future included in the model. In particular, GDP, unemployment, consumer confidence, CPI, and major stock indices like S&P and the Dow Jones Industrial Average.

References:

1. http://www.investorguide.com/igu-article-286-introduction-to-inflation-and-its-impact.html

2. http://www.bankrate.com/brm/ratewatch/fedDiscountRate.asp

3. http://www.washingtontimes.com/news/2009/feb/04/cbo-obama-stimulus-harmful-over-long-haul/

4. http://www.nytimes.com/2009/02/11/washington/11web-stim.html

5. http://findarticles.com/p/articles/mi_qn4188/is_20090101/ai_n31158972

6. http://www.reuters.com/article/politicsNews/idUSTRE51377B20090204?feedType=RSS&feedName=politicsNews

7. http://online.wsj.com/article/SB123620884593433947.html

8. http://www.bloomberg.com/apps/news?pid=20601087&sid=aG0_2ZIA96TI&refer=home#

9. http://online.wsj.com/article/SB123491033872703471.html