| Home | Quotes | Biographies | Free Essays and Articles | Discussion Forum |

Keynes, the Emperor with No Clothes

The idea of causality is certainly nothing new, and has in fact been around as long as science or reason has had any place in society. The very purpose of the scientific method, in fact, is to model the effects and consequences of an instigating action and ultimately prove by empirical data and reason that if A happens in such and such a manner, then B must follow. What was once only employed to discover the physical laws of nature has now found more broad and ambitious applications than determining the relationship between force and acceleration. Causality has thus interceded itself as the basis of a line of reasoning that has come to be known as Determinism. Determinism, at its most basic level, is the belief that “given a specified way things are at a time t, the way things go thereafter is fixed as a matter of natural law” (Hoefer)1. To make the conclusions of Determinism more readily apparent, consider Laplace’s thought demon, “an intelligence which in a single instant could know all the forces which animate the natural world, and the respective situations of all the beings that made it up” (Laplace 319)2. Laplace convincingly says that if such a beast were able to process all the data it would “be able to produce a single formula which specified all the movements in the universe… For such an intelligence, nothing would be ‘uncertain’, and the future, like the past, would be present before its eyes” (Laplace 319)2. Many, believing that such a thought demon need only know certain causes, like genetics or geography, have developed more specific deterministic theories by which they model the state of the human condition. Biological determinists, for example, no longer see “fate in the stars”, but instead they believe that “destiny is in our genes” (Melo-Martin 1184)3. Thus a biological determinist could make predictions as to how a child will grow up based on his genetic code. Problems arise when the direct link between genetics and physical manifestation is put under scrutiny. If a child has the potential to grow up to be six feet tall and strongly gifted in the sciences, it does not mean that the child will grow up to be six feet tall with a penchant for physics. Such a child could grow up in an abusive home where his diet causes him to be malnourished, thus stunting his growth, or such a child may forsake studies in the sciences so as to please his parents who despise science with a passion. No matter the environmental cause, it seems as if such narrow deterministic schools of thought exclude relevant variables in a causal chain. Still, the thought demon would necessarily know the environment in which the child was raised, and thus “legitimate objections arise only if such selected themes be erected into exclusive principles which govern and define our field,” or if the principle “is exaggerated to the detriment of other factors” (Lewthwaite 6)4. If the reader has been diligent, a logical flaw must have been made clear in any deterministic argument, mainly that any argument for determinism necessarily presupposes that “present events have a connection with previous ones that is based on the self-evident principle that a thing cannot come into existence without a cause that produces it” (Laplace 319)5. Violations of this principle can be made in conjecture, such as the concept of free will, but are more tangible in physics. The field of quantum mechanics developed out of the inability to identify the location of an electron in its orbit around an atom, which Heisenberg called the:

‘The Indeterminacy Principle’, or sometimes ‘The Uncertainty Principle’. And he, along with the majority of quantum physicists - those belonging to the so-called Copenhagen School - concluded that the behavior of the fundamental constituents of matter is therefore not deterministic but indeterministic. In their view, events at the microphysical level occur "randomly", "by pure chance" - meaning that they aren't determined by any causes whatever. (Bradley 1)6

This seemingly leads to particles behaving in a manner that is random, although probabilistically determinable. One might think that this would necessarily refute Determinism, because if the smallest of particles move randomly, then how can one say that larger objects, which are simply made of smaller objects, do not move randomly as well. Einstein, who said “God does not play dice with the universe”, had his doubts that this was true, but assume for a second that particles do indeed move randomly. When a ball is thrown off a cliff, the balls path as a function of time is very easily modeled by the simple laws of Newtonian Mechanics. Quantum Mechanics does not seem to play a part in it at all. In fact, if all relevant variables are taken into account, such as air resistance and the aerodynamics of the ball, the point the ball will land on and the exact time at which the collision will occur is a very simple matter to calculate with an almost certain degree of accuracy. In a similar manner, it is possible to model causality without loss of significant precision in the macro-economy, which like a ball thrown off a cliff, can be modeled with certain cause effect principles rather than force acceleration ones. Through a model of the macro-economy based on simple market theory, increased government expenditure will be ultimately shown to be at best ineffective and at worst a source of exacerbation of the current economic turmoil.

The most basic solution to the economic crisis is so general that details of the specific crisis need not even be considered. This approach is often referred to as the ‘do nothing and wait’ approach or alternatively the ‘no problem’ model of the economy, so called because it believes in market stabilization at full employment without need for external stimulus. While such an approach is certainly not ‘politically correct’, due to the very real likelihood that any advocate of such a plan would be politically crucified for what should be readily apparent reasons, it has some very solid grounding in economic theory. In terms of government policy, this theory ultimately suggests that a laissez-fare system of policy is best due to the fact that any government intervention would destroy the magic of markets, which is finding the socially optimum price and quantity of output.

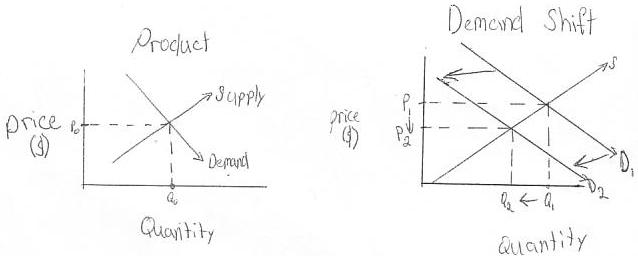

Just as an understanding of Newtonian mechanics is prerequisite to modeling the trajectory of a thrown ball, so too is an understanding of market theory vital to outlining causality in the macro-economy. The first thing to note is that a market graph is made up of an upward sloping Supply curve and a downward sloping Demand curve, both of which are graphed as quantity versus price. The relationship between quantity demanded and price should be readily apparent simply because it is intuitive, meaning that it is a graphical representation of consumer behavior and nothing more. A consumer will purchase more of a product at a cheaper price than he will at a higher price with all other variables held constant (ceteris paribus), and a supplier will produce more of a quantity if he can sell it for a higher price ceteris paribus. The intersection of the Supply curve and the Demand curve represents what is known as the market equilibrium price and quantity of output. This level of price and output is called socially optimum, not withstanding externalities, because this is the level of production at which both seller and buyer maximize their trade surplus, meaning that all who are willing to buy this product at a price which production is also willing to sell it at are able to consume this product and gain utility, or satisfaction. Markets also assign prices that achieve allocative efficiency, meaning that society’s inherently scarce resources are matched against the desires of a society to consume a given product. Two Supply and Demand graphs are shown below, the first simply to graphically represent what has been said above, and the second to show the effects of a change in one of the curves, in this case a leftwards shift of Demand (meaning that less quantity of the product is demanded at every price), on quantity outputted and the price of the product.

The market theory described above modeled a single product and a single firm; however the theory is very scalable to a look of the entire economy. The Supply-Demand graph now becomes a Short Run Aggregate Supply (SRAS)-Short Run Aggregate Demand (SRAD) graph which is again graphed as quantity versus price level. Price level in this case is a relative construct that measures inflation, and Aggregate Demand consists of Consumption (C), Investment (I), Government spending (G) and Net Exports (NX). Unfortunately, the reason the SRAS and SRAD curves are again upward sloping and downward sloping are not as intuitive as they are for a single product and firm. SRAD is downward sloping because of the real balance effect, which “describes a channel through which a change in real money balances, caused either by a change in the nominal money supply or a change in the nominal price level, impacts on household wealth and thereby affects consumption and output” (Ireland 2)7. The real balance effect in essence says that a change in price level results in a change in perceived wealth. This is due to the fact that if the price level goes down, a consumer’s savings can buy that much more goods and services due to increased purchasing power. To explain the slope of the SRAS curve, one must first realize that “producers in the U.S. economy are motivated mainly by profit. The profit made by producing a unit of output is simply the difference between the price at which it is sold and the unit cost of production” (Baumol 628)8. Should price level increase, the price at which the product is sold increases in one to one correspondence with the change in price level. The unit cost of production, however, may not change to the same extent that price increases to completely offset this added profit. Baumol attributes this phenomenon to the fact that:

The market theory described above modeled a single product and a single firm; however the theory is very scalable to a look of the entire economy. The Supply-Demand graph now becomes a Short Run Aggregate Supply (SRAS)-Short Run Aggregate Demand (SRAD) graph which is again graphed as quantity versus price level. Price level in this case is a relative construct that measures inflation, and Aggregate Demand consists of Consumption (C), Investment (I), Government spending (G) and Net Exports (NX). Unfortunately, the reason the SRAS and SRAD curves are again upward sloping and downward sloping are not as intuitive as they are for a single product and firm. SRAD is downward sloping because of the real balance effect, which “describes a channel through which a change in real money balances, caused either by a change in the nominal money supply or a change in the nominal price level, impacts on household wealth and thereby affects consumption and output” (Ireland 2)7. The real balance effect in essence says that a change in price level results in a change in perceived wealth. This is due to the fact that if the price level goes down, a consumer’s savings can buy that much more goods and services due to increased purchasing power. To explain the slope of the SRAS curve, one must first realize that “producers in the U.S. economy are motivated mainly by profit. The profit made by producing a unit of output is simply the difference between the price at which it is sold and the unit cost of production” (Baumol 628)8. Should price level increase, the price at which the product is sold increases in one to one correspondence with the change in price level. The unit cost of production, however, may not change to the same extent that price increases to completely offset this added profit. Baumol attributes this phenomenon to the fact that:

Many of the prices that firms pay for labor and other inputs are relatively fixed for periods of time--though certainly not forever. Often, workers and firms enter into long-term labor contracts that set money wages up to 3 years in advance. Even where there are no explicit contracts, wage rates typically adjust only once a year. During the interim period, money wages are fixed. Similarly, a variety of material inputs are delivered to firms under long-term contracts at prearranged prices. (Baumol 628)9

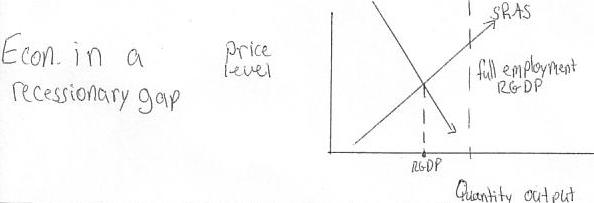

As price level increases, the quantity produced increases, and SRAS is thus upward sloping. The intersection of SRAD and SRAS in this model represents Real Gross Domestic Product (RGDP), which is defined as “the total market value of all final goods and services produced annually within a country’s borders” adjusted for inflation (Arnold 132)10. The economy is currently in a recession, which means that RGDP has been decreasing for at least two quarters. This means that the current total output of the economy is less than that of full employment output. This is graphically represented below by the intersection of SRAD and SRAS being to the left of full employment output due to a decreased SRAD curve.

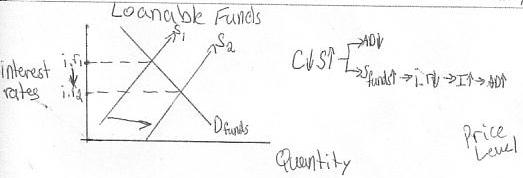

The ‘no problem’ approach to the economy states that the economy is self-regulating and can heal itself of its woes without outside interference. To examine this in terms of the current recession, say that people begin to save more of their income rather then spend it, causing SRAD to fall. A classical economist would look towards the credit market to force the economy into producing a RGDP representative of full employment. A classical economist thus believes in the “automatic adjustment [that] takes place between saving and the opportunities for employing capital profitably” (Flux 95)11, also called the savings-investment link. Thus the classical economist looks towards the loanable funds market, in which Demand for funds represents Investment spending and the amount of money people save represents the Supply curve. An increase in savings means that the supply of funds in the credit market shifts to the right. This decreases the interest rate (look at the graph below) which causes Investment spending, which is a component of SRAD, to rise. A fall in Consumption, which is really just an increase in savings, thus causes a decrease in SRAD, but is quickly remedied by a decrease in interest rates and a subsequent increase in Investment spending which restores SRAD to its original position.

The problem with the ‘no problem’ approach, a Keynesian economist would say, is the mere existence of the Great Depression. During the Great Depression, people indeed began to save more of their income. A downward sloping demand curve in the credit market, which basic market theory can explain, “dictates that people and businesses are willing to borrow more at a lower interest rate. During this time period, there was an actual surplus of funds to be loaned out. People were more interested in saving as much of their money as possible and businesses were not interested in borrowing the saved income” (Michelle)12. It is not that Keynes, who offered the first critique on the classical self-regulating economy, believed that interest rates and Investment spending were completely independent of each other; he just doubted that they were in one to one correspondence with each other. Thus he doubted whether an increase in savings is equally matched by an increase in Investment spending (Keynes XIV)13. Investment spending, for example, can be insensitive to interest rates, meaning that interest rates could be zero and still no investment of new capital would occur on the side of business. This would disallow the economy from self-regulating through the credit market. Thus Keynes believed that if SRAD dropped, it would not be offset by an equal increase in Investment spending, and the economy could be in equilibrium without being at full employment RGDP.

Classical economists did not believe that the credit market was the only market available to help the economy attain full employment equilibrium. Indeed, a large portion of their argument rested on self-regulation through what is known as the labor market. In the labor market, the firms act as demanders of labor and workers act as suppliers of labor. The two curves are graphed as quantity versus wage rates. Again begin with the current state of the economy, with SRAD shifted to the left of what would cause an intersection with SRAS at full employment. Assume also that the increase in savings that happens hand in hand with the decrease in consumption is plagued by Investment insensitive spending, as it is in the current economy. Keynes says that the economy is thus in equilibrium without being at full employment, however the classical economist believes that the increase in unemployment, which the decrease in SRAD causes, actually remedies itself through the wage market. To see why this is so, realize that an increase in unemployment actually increases the Supply of labor in the labor market, which is graphically represented by a rightwards shift of the Supply of labor curve, thus decreasing the wage rate, which allows for firms to hire more workers. Firms hiring more workers, due to cheaper wage rates, is represented by a rightwards shift of SRAS, thus causing the intersection of SRAS and SRAD to once again be at full employment RGDP.

With no end to the Great Depression in sight, Keynes took it upon himself to explain why the economy may fail to self-regulate through the labor market. Keynes proposed that perhaps wage rates, like investment spending, can be inflexible. Although Keynes himself failed to offer a complete explanation for inflexible wage rates, there have since been numerous good reasons to explain this phenomenon. One explanation is that there are benefits to long-term labor contracts to both employers and employees, thus disallowing changes in wage rates until the contracts expire. Keynes offered that employers may pay efficiency wages rather than subsistence wages and thus business cannot always lower wages because they would incur additional costs in terms of decreased marginal worker productivity. In addition, a fully self-regulating economy would go back to fully employment RGDP only at a lower price level. Keynes believes that markets may not be competitive enough for prices to be flexible enough for this to happen (Arnold 198)14.

With no end to the Great Depression in sight, Keynes took it upon himself to explain why the economy may fail to self-regulate through the labor market. Keynes proposed that perhaps wage rates, like investment spending, can be inflexible. Although Keynes himself failed to offer a complete explanation for inflexible wage rates, there have since been numerous good reasons to explain this phenomenon. One explanation is that there are benefits to long-term labor contracts to both employers and employees, thus disallowing changes in wage rates until the contracts expire. Keynes offered that employers may pay efficiency wages rather than subsistence wages and thus business cannot always lower wages because they would incur additional costs in terms of decreased marginal worker productivity. In addition, a fully self-regulating economy would go back to fully employment RGDP only at a lower price level. Keynes believes that markets may not be competitive enough for prices to be flexible enough for this to happen (Arnold 198)14.

In the long run, which by definition means that all variables are held flexible, Keynesian theory doesn’t hold any water. This is because in the long run labor contracts will have to be renewed, meaning that wages are flexible and prices will have time to adjust, meaning that prices are also flexible. The question, then, is how long it will take until the economy is in the long run, and whether government intervention can help speed up the recovery of the economy in that interim time.

Keynes believed that government Fiscal Policy could help bring an economy out of a recession. His economic chain of causality begins with the insight that consumption makes up a large majority of SRAD. In addition people consume in proportion to their disposable income, the amount of money they have left after taxes. This relationship between disposable income and consumption is not a one to one correspondence, however, and is related by the Marginal Propensity to Consume (MPC). For example, if someone’s disposable income $100, and his MPC is .9, then he consumes $90 worth of goods. Keynes also believed in the phenomenon known as the multiplier. The $90 that a consumer spends is turned into income for someone else, who spends .9 of $90 which is $81 which again is turned into income for someone else… In mathematics this is a converging geometric series which has a sum equal to the initial sum * 1/(1-MPC). In this case, $100 of spending actually creates a change of $1000 in the total RGDP. An equivalent tax change would only cause a $900 change in RGDP due to the loss of the initial entire spending of the $100 that the government injected. The Keynesian model of the economy thus invites government tinkering to fix a recession through a multiplier effect. If the current SRAD has shifted to the left causing unemployment, all the government has to do is increase government expenditure or decrease taxes, which although weaker than government expenditure changes has the added benefit of shifting the Aggregate Supply curve as well, so as to create more disposable income for people, which will cause an increase in Consumption and thus shift SRAD to the right. With this theory in mind, government stimulus plans and tax cuts should theoretically get the economy out of a recession if they are composed of enough money. Thus the United States solution to the crisis is a “projected fiscal deficit of $1.2 trillion and monetary injection of almost $2 trillion by the Fed… Keynesians argue that even trillions are not enough. Really?” (Aiyar)15

Something seems a little… off about throwing money at the economy in hopes of fixing it. Perhaps cynicism blinds, but it seems too convenient that while everything in the universe subscribes to the laws of thermodynamics, the economy is an exception to the rule of conservation of energy. Or maybe the phrase “There’s no such thing as a free lunch”, the title of a book by Milton Friedman, comes to mind to dispel the notion that throwing money at the economy can be done without consequence. With a little more knowledge on how the economy got to be the way it is, this ineffable feeling of wrongness is given words by Albert Einstein: “We cannot solve our problems with the same thinking we used when we created them”. Therefore “before we go rushing off and enacting solutions to a problem perhaps we ought to take a step back and figure out just how we ended up in this mess” (Reeser 1)16. Reeser blames the crisis not on deregulation, as the government may have us believe, but rather on forced regulation that stripped the economy of the protections that profit seeking behavior naturally endows it with. Fannie Mae was chartered by the Federal Housing Administration with the purpose of addressing “the inability or unwillingness of private lenders to ensure a reliable supply of mortgage credit throughout the country” (Reeser 1)17. Thus the purpose of Fannie Mae was “to purchase, hold or sell FHA-insured mortgage loans originated by private lenders” (Reeser 1)18. Freddie Mac was essentially created for the same purpose but served to make sure that Fannie Mae did not have a monopoly of the industry (Reeser 2)19. Ben Bernanke, chairman of the United States Federal Reserve, commented on the consequences of these two government sponsored enterprises in his speech on the evolution of the Community Reinvestment Act:

Securitization of affordable housing loans expanded, as did the secondary market for those loans, in part reflecting a 1992 law that required the government-sponsored enterprises, Fannie Mae and Freddie Mac, to devote a percentage of their activities to meeting affordable housing goals (HUD, 2006). A generally strong economy and lower interest rates also helped improved access to credit by lower-income households. (Bernanke)20

Thus the housing bubble which prompted the economic recession was actually promoted by both government fiscal policy, the 1992 law, and government monetary policy of lowering the federal discount rate (Changes to the Fed Funds and Discount Rates)21, which created the artificially low interest rates that Bernanke references. Private lenders, necessarily weary about making loans that may not be repaid lost all capitalist inhibitions when they realized that they could quickly sell repackaged mortgages to Freddie Mac and Fannie Mae simply because by forcing these government sponsored enterprises to buy sub-prime mortgages, the government was guaranteeing a market Demand for these risky loans. In conclusion to the current crisis, “those who don’t want the market to work will complain how the market has failed when it is really government intervention in the market that has failed. Thus bad regulation breeds more bad regulation until disaster occurs and the cycle is thus restarted” (Reeser 6)22. Still, this only goes to show that government should not have interfered in the first place; the question still remains as to whether good policy and government injection of money can help get the economy out of the recession.

Monetarists, led by their apostle Milton Friedman, speak to the problems of injecting new money into the economy and show ultimately how increased government spending does not necessarily solve the problem of unemployment. First, assume that government intervention can have some positive effect, which is in and of itself suspect. If government increases spending without cutting taxes (note that a tax increase would ultimately nullify their intended change), then the government is running a deficit. The government has to get the money to spend from somewhere, so they borrow it. This shifts the demand curve out in the loanable funds market and increases interest rates. An increase in interest rates results in lower Investment spending which may partially or even fully offset the increase in SRAD due to increase government spending, an effect called ‘Crowding Out’ (Arnold 229)23. The best a Keynesian economist could hope for is that the effects of an increase in interest rates only partially block the desired results of the spending changes that they enact. Suppose this to be the case. There still remains the more pressing concern of timing. There are in fact multiple delays involved when dealing with tinkering in the macro-economy. Arnold’s textbook outlines just five types of lags: the data lag, the wait-and-see lag, the legislative lag, the transmission lag, and the effectiveness lag. Most pertinent to the current discussion is the data lag which is due to the fact that the macro-economy is seen only hindsight. This means that if the economy is entering a recession, policy makers may not know it until months have passed. The legislative lag has all but been eradicated due to the incredible speed with which Obama pushed his stimulus plan through Congress. All that is really left is the effectiveness lag which is a measure of how long it takes for increased government expenditure to effect the economy (Arnold 232)24. A monetarist would argue that “by the time the full impact of the policy is felt, the economic problem it was designed to solve (1) may no longer exist… (3) or may have changed altogether” (Arnold 232)25. Doherty, quoting Friedman, says that “even if fiscal policy could have some useful effects, which Friedman doubted, there’s no reason to believe government managers could use the policy at the right times and in the proper amounts to achieve the desired effect… what government fiscal manipulations really tended to do was introduce ‘a largely random disturbance that is simply added to other disturbances’” (Doherty)26. To further the argument, Friedman argues that government injections of money into the economy do not even have the desired effect to begin with because they are inherently inflationary, regardless of the timing. Friedman also redefined the concept of the consumption function, which Keynes believed to model consumption of a consumer:

Consumption decisions were instead based on a theoretical construct Friedman called “permanent income.” If someone gains a sudden windfall, he isn’t apt to spend it all immediately; if he suffers a sudden loss, he isn’t apt to immediately cut his consumption by the amount of that loss. One implication of this theory is that if the government attempts to manipulate our economic behavior through quick tax raises or cuts here and there, the effects are not likely to be what the politicians hope for. Doherty27

The multiplier that is so integral to Keynesian theory is reduced to the value of one because people “[know] even if politicians [do] not, that the old spending spree [has] to stop” (Aiyar)28. This means that all of the money the government is putting into the economy is essentially just money that it has taken out of the economy. Friedman believed that there “is always a temporary tradeoff between inflation and unemployment; there is no permanent tradeoff” (Friedman 11)29. Thus “only with constantly accelerating rates of inflation can the initial Phillips Curve effect that increased employment keep working—and that path can end only by reducing the currency to uselessness” (Doherty)30. This means that the government can temporarily increase employment and thus shove the recession under the rug so to speak, but for it to permanently delay the recession it must increase inflation at an increasing rate, which ultimately leads to hyperinflation. Furthermore, the increasingly larger amounts of government expenditure that would be needed to permanently delay recession would render the United States no different than a socialist state.

Ultimately, Friedman does not necessarily offer a solution to the problem. Then again, maybe a magic wand solution to the economy is something that just does not exist. The ridiculously low interest rates that followed the 2000 recession only delayed recession instead of curing it, perhaps causing the bubble to only grow in size by engorging other sectors of the economy. The economy was living on borrowed time which has since run out. The consequences of former federal Reserve chairman Alan Greenspan’s low discount rate are only now being made apparent and any further tinkering will only prolong the suffering at best, or put it off only to magnify it in the future at worst. Alan Greenspan, referring to claims that he caused the housing bubble due to decreasing the Federal discount rate says that “between 2002 and 2005… the correlation [between the federal discount rate and the U.S. mortgage rate] diminished to insignificance” (Greenspan)31. In an article titled “How Dumb Does Alan Greenspan Think We Are? Very”, the relationship between the federal discount rate and adjustable rate mortgages is determined to still be tightly correlated, as it always has, disproving Greenspan’s claims. Furthermore, Fiderer suggests that the timing of the funds rate is highly suspect and that Greenspan may have lowered the funds rate so as to prime the pump for the 2004 election by causing a temporary unsustainable boom, making the consequences of his actions felt only after the election was over (Fiderer)32. The Great Depression still looms over economic policy, yet one underappreciated fact about the Great Depression is that inflationary policy itself may have prevented the economy from self-regulating. This is due to the fact that the self-regulating view of the economy relies on a decrease in price level while policy during the Great Depression was largely inflationary. Though the economy may take some time to naturally go back to full employment, it will only take this long because of initial government intervention and may take longer yet with increased government expenditure and intervention.

To recapitulate, the economy is causal with the foundational cause-effect relationships being derived from basic market theory. The economy has several markets through which it can self-regulate to full employment output. Although Keynes says that in the short run these markets may not prove to flexible enough to achieve full employment output, and thus economy may be in equilibrium without being at full employment, the alternative, increased government spending, does not cure the economy due to its inflationary nature and its limited multiplier effect due to consumer expectations. Government spending only redistributes resources in a manner that by the very nature of government doing the redistribution, rather than markets, is not socially optimal.